Almost one hundred and fifty years after the introduction of the automobile, car manufacturers face a new set of challenges. Electrification of their product portfolios is one priority. Another is the transition to energy-efficient, software-defined vehicles whose (intelligent) functions are enabled through high-performance computers and myriads of lines of code. And across the board is society’s call for increasingly advanced safety features to limit the number of traffic fatalities to an absolute minimum.

As the automotive industry picks up on these requirements and translates them into commercial features that gradually find their way into our cars, a safer, more personalized, more sustainable driving experience can be realized. Yet, all the while, these challenges (and the technological innovations that come with them) increasingly cause the automotive sector to depend on chips or semiconductors.

Cars become (high-performance) computers on wheels

The era when automobiles were solely defined by mechanical features like horsepower and torque is long gone. Instead, the focus has now shifted towards developing smart and personalized high-performance supercomputers on wheels that provide an entirely new driving experience – characterized by advanced driver assistance systems (ADAS), in-vehicle infotainment, and in-cabin health monitoring.

The rise of such software-defined vehicles brings a host of exciting opportunities and innovative applications, but it also introduces a new layer of complexity. For one, car manufacturers are tasked with building hardware platforms that should support millions of lines of software code, and countless applications that require continuous, secure updates. A second observation is that incrementally adding services is no longer effective because of (computing) space constraints. And, finally, supply chain challenges must be addressed to ensure smooth operations.

In other words, we are on the brink of a paradigm shift. It will require car builders and their partners to reinvent R&D practices, as well as the underlying supply chain and collaboration models.

Leaving a mark on chip makers’ strategic roadmaps

Ever since car manufacturing entered the era of mass production, the focus has primarily been on optimizing hardware and developing durable mechanical components that should last throughout a car's lifetime. However, relying solely on hardware innovations has its limitations in addressing the upcoming challenges in the automotive sector. A more integrated approach is needed, where hardware and software are co-developed and co-optimized in an agile manner.

It is an evolution that goes hand in hand with the use of digital twin technology, replicating a car's features and functionality in the cloud – including its software, mechanics, electronics, and physical characteristics. This enables simulating, optimizing, and validating each step in the car's development process, allowing for the identification of problems and potential failures as early as possible. In other words, processes and working principles that have not been questioned for decades will have to be rethought.

Furthermore, new collaboration models are required, particularly between car manufacturers and chipmaking companies. This collaboration should extend to the point where the former actively participates in defining the specifications and characteristics of the next generations of microchips to be used in automotive.

After all, considering car builders’ pressing challenges and requirements, the underlying chip technology requires another quantum leap forward. Despite the huge progress the semiconductor industry has made in recent years, chips do not yet harness the computing power, nor energy efficiency to build tomorrow’s automotive systems. Adding to this complexity is that chip technology being developed today should still be relevant in twenty years (a car’s average development time and lifespan). In other words: it is time for car manufacturers to leave their mark on chip makers’ strategic roadmaps.

Europe’s ‘Vision Zero’: a key driver behind the ecosystem’s research agenda

Coming up with innovations that improve and personalize people’s driving experience remains top of mind for car manufacturers: it is nothing short of their competitive edge. But road safety also acts as a key driver behind the ecosystem’s research agenda.

Studies from the American National Highway Traffic Safety Administration (NHTSA) show that human error (e.g., misjudgment, speeding, fatigue, intoxicated or distracted driving, etc.) is the cause of more than 90 percent of all motor vehicle accidents.

“Cars need to be built that can sense their surroundings, anticipate the intentions of road users, and interact with each other and the roadside infrastructure.”

These staggering numbers illustrate how difficult it will be to realize governments’ increasingly ambitious road safety targets – such as the European Union’s ‘Vision Zero Initiative’ that aims at achieving a near zero fatality rate on EU roads by 2050. It explains why high hopes are put on the introduction of advanced driver assistance systems that can minimize or prevent the chance of human (driving) errors.

To bring Europe's Vision Zero to fruition, even though achieving absolute zero traffic fatalities may be challenging, vehicles need to be equipped with advanced sensing capabilities that can anticipate the intentions of road users and interact seamlessly with other vehicles and roadside infrastructure. This necessitates the development of chip technology with increased computing power and energy efficiency. However, it is imperative to also prioritize affordability. After all, the true impact of these technological advancements can only be realized when tomorrow's smart cars are accessible to a wide range of people, rather than being overly expensive and exclusive.

Creating cars that can ‘sense’ their surroundings

The first question is how to create cars that can sense and assess what is happening – both in-cabin and around them. This is fundamental if we want to build driver assistance systems that meet (and exceed) the capabilities of human drivers.

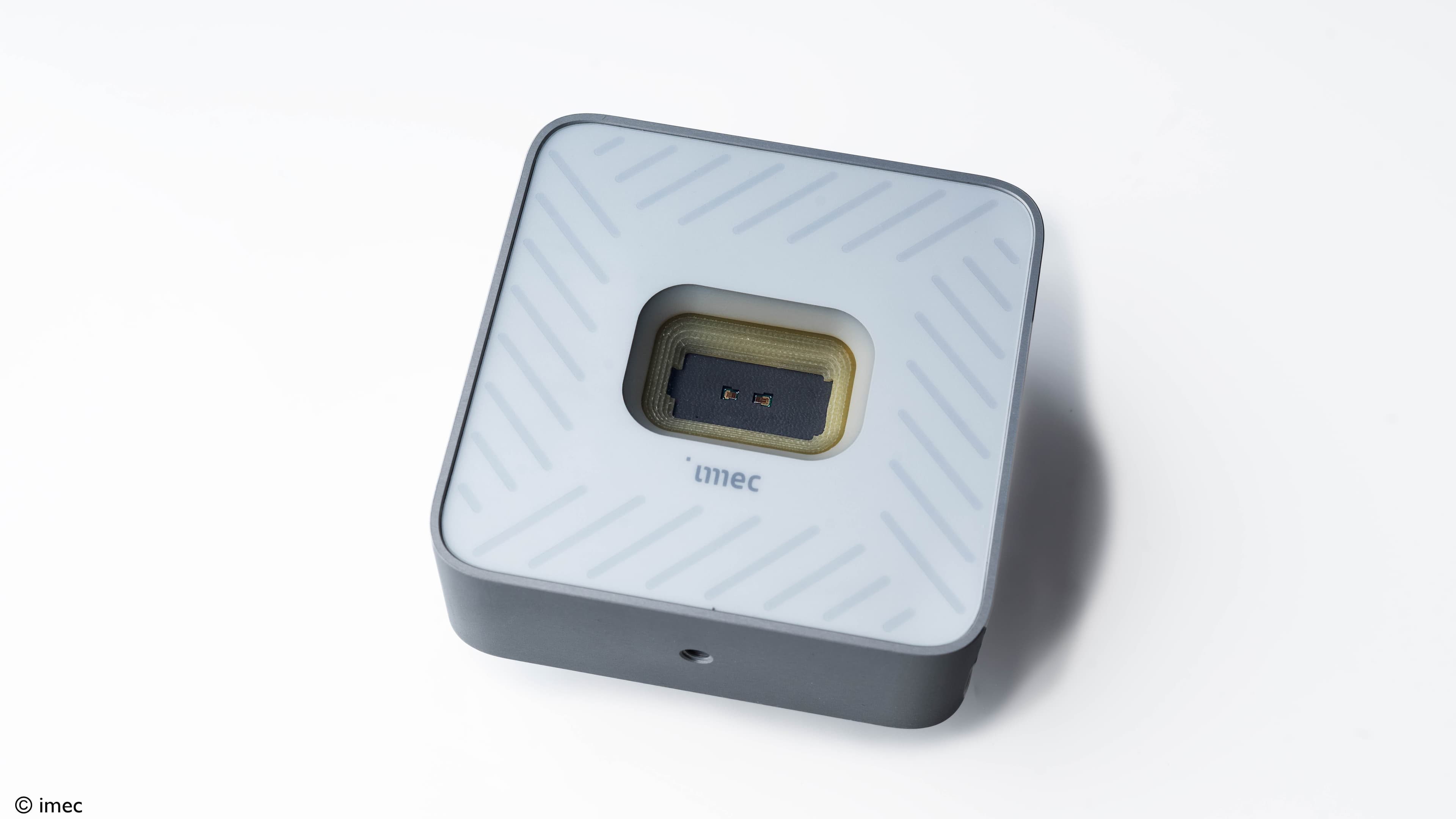

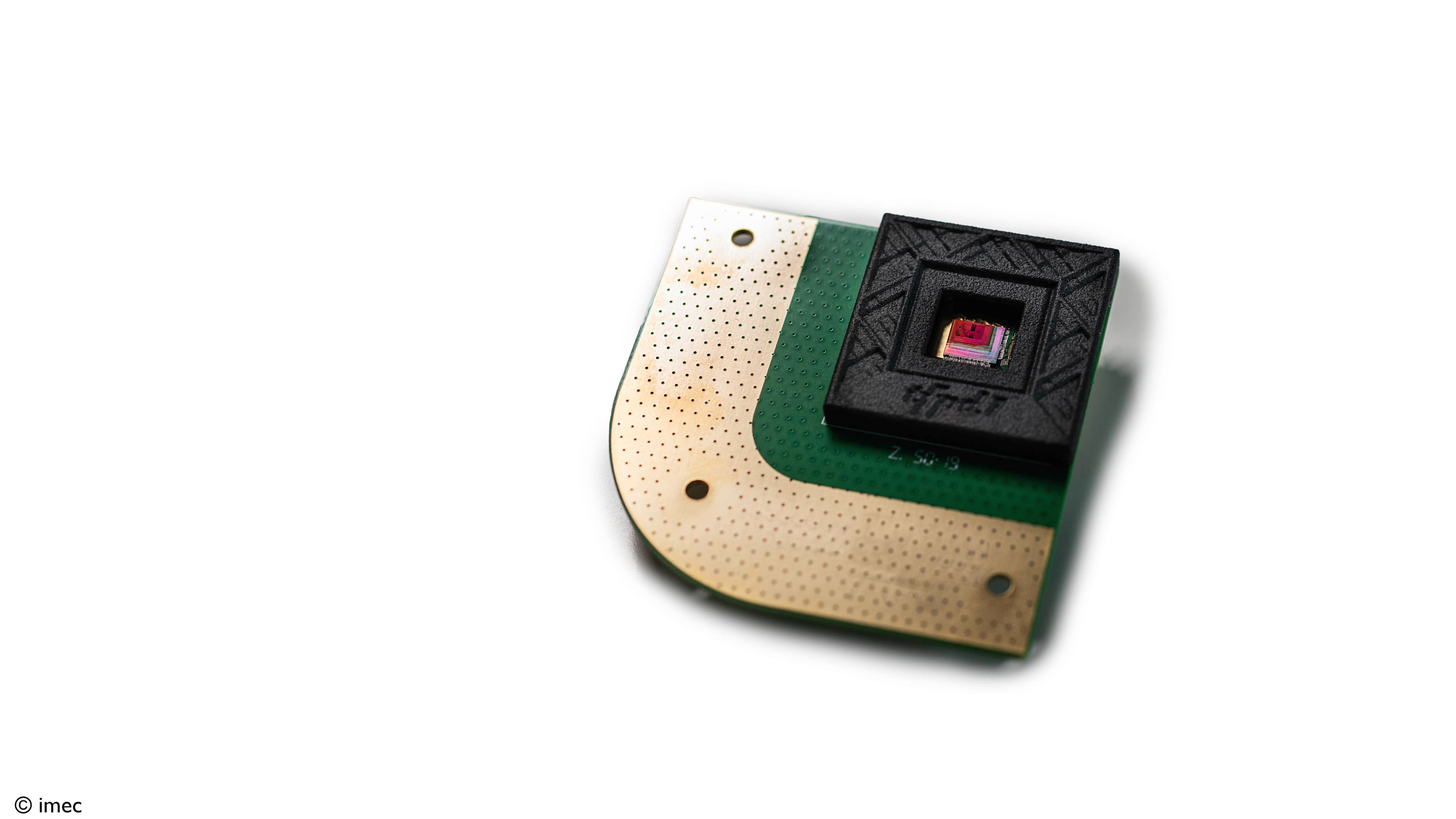

Initial steps in this direction have already been taken with the development of a new generation of sensors that come with better performance, increased cost-efficiency, and lower energy consumption. Additionally, we require sensor (fusion) systems that combine camera, radar, and (ultimately) lidar technology. Together, they can provide a high-quality, 360° view of what happens in and around a car, regardless of road and weather conditions.

While this seems straightforward at first, it comes with a wholly new design principle. It requires the longstanding barriers between automotive’s hardware and software suppliers to be broken down, and for the ecosystem to focus on hardware/software co-development and co-optimization.

Anticipating instead of observing

When it comes to data collection, projections show that by 2030 each car could generate a staggering ten to twelve terabytes of data daily, output that must be processed both in the car and in the cloud.

And some companies even want to go a step further. Whereas today’s sensor systems are limited to ‘observing’ their surroundings, several players have set out to develop solutions that can predict road users’ intentions. Think of cyclists who – before turning left – start to deviate slightly from their original trajectory. If driver assistance systems could capture these subtle cues, they would ultimately be able to anticipate (potentially dangerous) traffic scenarios, just like human drivers do.

While having this functionality will be key to increasing road safety, we are not there yet. Creating such a solution hinges, amongst others, on the development of custom-built logic chips that combine significantly improved computing power with much better energy efficiency.

Interacting with the roadside infrastructure – and one another

Although a car's key safety functions should be ‘always-on,’ even when a network connection is lacking, modern cars are no longer isolated entities. They are constantly connected to the world, sharing important sensor data with other cars and roadside infrastructure 24/7.

This exchange of information enhances traffic safety by allowing emergency vehicles to receive priority management at hazardous intersections and enabling ‘looking-around-corners' use cases. However, this connectivity relies heavily on a stable wireless network connection, which is why car manufacturers are particularly interested in 5G and 6G mobile access technology.

Compared to today’s mobile networks, 6G will tap into higher radio frequencies to combine wide geographical coverage and high bandwidths with limited signal delay. But this is exactly where one of the main challenges arises, as current telecom chips lack the transmit power and energy efficiency to operate at frequencies of 100 GHz and beyond. It explains why the chip industry has started to experiment with new semiconductor materials that are more up to the job.

Mobilidata – a pioneering mobility data-sharing project

Mobilidata is a pioneering project in mobility data sharing, developed by the Flemish government in partnership with imec. The aim of this groundbreaking initiative is to facilitate real-time and privacy-conscious exchange of data between vehicles and roadside infrastructure. Traditionally, much of this data is only available to public services, restricting its potential use cases. Mobilidata seeks to change this by exploring innovative ways to share mobility data.

Mobilidata has resulted in an architecture that enables navigation app builders, car manufacturers, and other service providers to access up-to-date traffic information. This data can then be used to enhance driver warnings, provide speed advice based on roadworks, or help drivers find parking spots on the outskirts of town. However, Mobilidata recognizes that offering improved mobility options should not be restricted to cars alone; they should also encompass sustainable travel modalities. Hence, the project focuses on developing technology solutions that support various modes of transportation – for instance, by suggesting secure bicycle parking options to commuters.

Mobilidata’s comprehensive architecture and wide range of use cases make it the most advanced mobility initiative in Europe.

Improving semiconductors’ energy efficiency

As previously mentioned, energy efficiency is a hot topic in automotive – and that is not a coincidence: advanced chips’ growing energy requirements are totally at odds with electric vehicles’ limited battery capacity. And what good is a smart, autonomous car if it needs to be recharged every couple of miles? In other words: semiconductor technology’s energy consumption must be reduced considerably.

Novel artificial intelligence (AI) approaches that dynamically trade off (edge and cloud) computing resources are one way to help reduce overall energy consumption. Still, the semiconductor industry will need to pursue further energy efficiency improvements, as (electric) cars’ driving range continues to be one of OEMs’ primary selling points.

“The automotive industry is up for a bumpy ride. Its challenges can only be tackled successfully if the entire ecosystem joins forces on an international and cross-sectoral level.”

A call for international and cross-sectoral cooperation

So, what lessons can we draw from this? If one thing is clear, it is that the automotive industry is up for a bumpy ride. Powertrain electrification, hardware-software co-optimization, and the development of ADAS systems in pursuit of increased road safety are challenges that can only be tackled successfully if the entire ecosystem joins forces on an international and cross-sectoral level.

Within this ecosystem, a lot of weight rests on the semiconductor industry’s shoulders – as chip technology in particular requires another quantum leap forward. Initiatives such as the European Chips Act or the American CHIPS & Science Act will be instrumental in getting there. They will boost regional research and development efforts, help us preserve geopolitical equilibria and help us cope with supply chain hiccups.

But across the board, as they are positioned in the midst of this rapidly evolving landscape, it will be paramount for car manufacturers to help define the specs of the next generations of microchips. It is a new and tight(er) collaboration model the semiconductor industry is eager and ready to engage in.

The European Chips Act: a golden opportunity for Europe’s car manufacturing industry

As global competition intensifies, European carmakers recognize that the key to success lies in the development of reliable, scalable, and energy-efficient technology. Against this backdrop, the European Chips Act – which was created to address chip supply issues and geopolitical challenges – presents a golden opportunity for the European car manufacturing ecosystem to regain a leading position.

The Chips Act aims to establish pilot lines that expedite hardware-software optimizations in the domains of edge AI, FDSOI, quantum, and III-V materials while accelerating critical automotive technologies' transition from research to commercialization. Think of sensor systems and mobile connectivity solutions. These pilot lines will also be supported by cloud-based design platforms to provide the chip community with easy access to the latest technology improvements. Moreover, the Chips Act supports current chip technology as well, boosting its supply chain resilience, and acknowledging its long-term importance for the car manufacturing ecosystem.

Professor Steven Latré, is leading imec’s artificial intelligence research. His main expertise focuses on combining sensor technologies and chip design with AI to provide end-to-end solutions in sectors such as health and smart industries. Next to this, he is also a part-time professor at the University of Antwerp.

Bart Placklé holds a Master of Science degree and a postgraduate degree in telecommunications from the University of Hasselt (Belgium), and imec (Leuven, Belgium), respectively. He also obtained a postgraduate degree in executive business economics from KU Leuven (Belgium).

Bart started his career at Acunia, an imec spinoff, where he initially served as a lead silicon designer and later advanced to become the general manager of the hardware business unit.

In 2004, Bart joined Intel to create the company’s in-vehicle infotainment business. As chief architect and later automotive CTO, he led the development of five generations of high-performance automotive solutions, driving Intel’s automotive segment to become a multibillion-dollar business. In recognition of this contribution, Bart received the Intel Achievement Award in 2016. In 2021, Bart was appointed as the CTO of AXG Mobility-as-a-Service at Intel.

In 2023, Bart Placklé returned to imec, assuming the role of vice president of automotive technologies. In this capacity, he is leading the development of cutting-edge solutions that will shape the future of mobility.

Published on:

6 April 2023